Joshua Ohl, CoStar’s director of market analytics, recently published insightful data on San Diego’s apartment pipeline.

The growth of new units in San Diego remains steady and stable in sharp contrast to the national trend, which saw a 40% year-over-year reduction. According to Joshua Ohl, CoStar director of market analytics, “roughly 4,800 market-rate units were completed across the San Diego region, marking the third most units to open in a calendar year in the past decade. Developers are on track to complete 3,200 market rate units this year.” The San Diego market experienced a 7% annual decline compared with 2023 but still represents the fourth highest number of unit starts in the past 20 years. Mission Valley leads the region in growth with 2400 units begun. Balboa Park and Chula Vista are also growing, with 1,800 and 1,100 in the pipeline.

Notably, construction continues to lean toward one-bedroom and studio units, with only 28% two-bedroom and under and only 10% three and four-bedroom units. As developments continue to favor smaller units over multiple bedrooms by a two-to-one margin, growing families will have fewer units to choose from.

Real estate tracker CoStar says average rents in San Diego County are stable, up 0.8% yearly. In a February report, Zumper ranked San Diego as the ninth most expensive rental market. Zumper reports that San Diego is among the top five cities where renters report that they are planning to move. We peg average rents at $2775 monthly with a 2.75% vacancy rate.

Contact Us for Help

Staying on top of the market is not easy. Cal-Prop expertly manages these time-consuming tasks so you don’t have to. Call us to discuss how we can help save you time and money. Please contact us at Cal-Prop Management. We work with investors in San Diego and the surrounding areas.

Additional Resources:

Joshua Ohl’s insightful article regarding the apartment pipeline is attached below and linked here https://www.pacificcoastcommercial.com/post/san-diego-s-apartment-pipeline-steady-as-ever for your reference.

https://www.zumper.com/#rent-report

San Diego’s Apartment Pipeline Steady As Ever

Smaller units dominate new inventory

By Joshua Ohl

CoStar Analytics

March 10, 2025 | 1:24 p.m.

Last year, roughly 4,800 market-rate apartment units were completed across the San Diego region, marking the third-most units to open in a calendar year in the past decade. This year, developers are on track to complete 3,200 market-rate units.

The new properties that have opened are heavily tilted toward smaller units. Last year, nearly 50% of the opened units were one-bedrooms, while studios comprised 14% of the new inventory. Conversely, only 28% of new units in 2024 were two bedrooms, and under 10% comprised three—and four-bedroom units. That trend has largely held in place since 2017 and is the reverse of the unit mix that was added between 2001 and 2014.

According to more than one local builder, local developers have pivoted toward smaller units due to their ability to add more units and higher rents on a per-square-foot basis. For instance, the average asking rent for studios opened in 2024 is $5.10 per square foot compared with $4.25 per square foot for the two-bedroom units opened last year. There were roughly 1,000 more one-bedroom units built in 2024 compared with two bedrooms, and average asking rents are $.30 more per square foot.

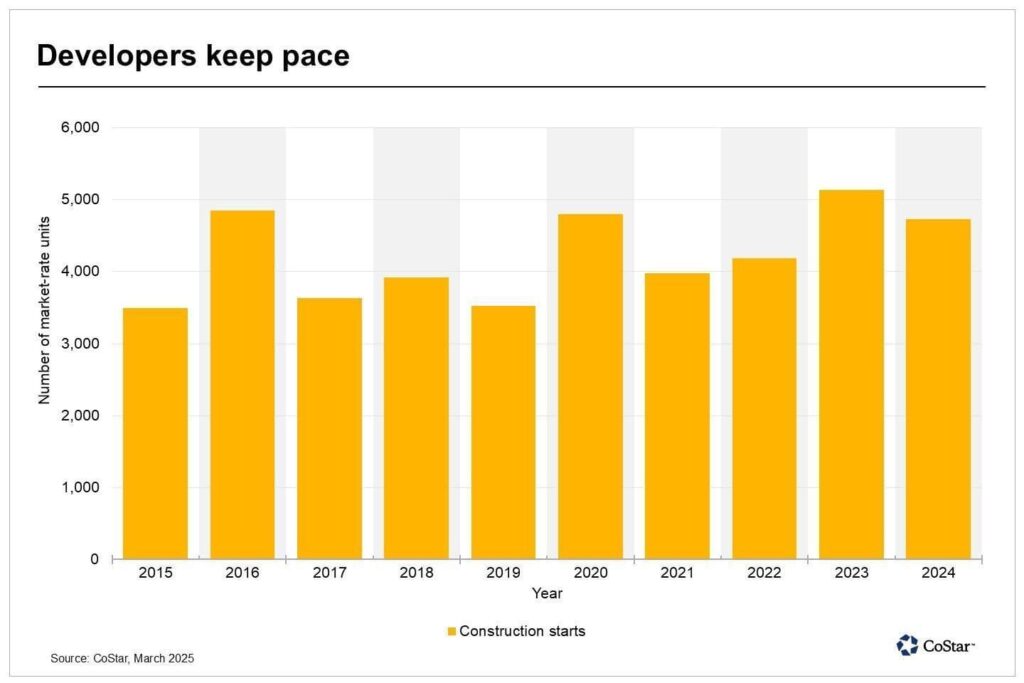

However, unlike the national trend, which saw an apparent reduction in groundbreakings in 2024, when they fell 40% year over year, San Diego’s pipeline remains as consistent as ever.

Last year, builders broke ground on over 4,700 market-rate apartments, representing a 7% year-over-year decline compared with 2023. Yet it also marked the fourth-highest number of market-rate units to break ground in San Diego in the past 20 years.

Although some projects have been placed on hold due to higher construction and debt costs, at the end of 2024, there were still 9,000 market-rate units in the pipeline, a hair higher than the five-year average.

The heaviest pockets for construction will sound familiar. The Mission Valley area leads the region, with 2,400 market-rate units in the pipeline. Nearly 1,800 units are under construction in the Balboa Park neighborhoods, and over 1,100 are being built in Chula Vista.

Downtown’s pipeline thinned notably by the end of last year, with less than 900 units under construction after 1,900 new market-rate units opened in 2024.

As developers continue to bring smaller units to market at a nearly two-to-one margin over units with multiple bedrooms, it could be more difficult for growing renter households to remain in the San Diego region because they have fewer larger units to choose from.

All content provided on this blog is for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. The owner will not be liable for any errors or omissions in this information, nor for the availability of this information. The owner will not be liable for any losses, injuries, or damages from the display or use of this information.

All content provided on this blog is for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. The owner will not be liable for any errors or omissions in this information, nor for the availability of this information. The owner will not be liable for any losses, injuries, or damages from the display or use of this information.